Strata Levels Framework Overview

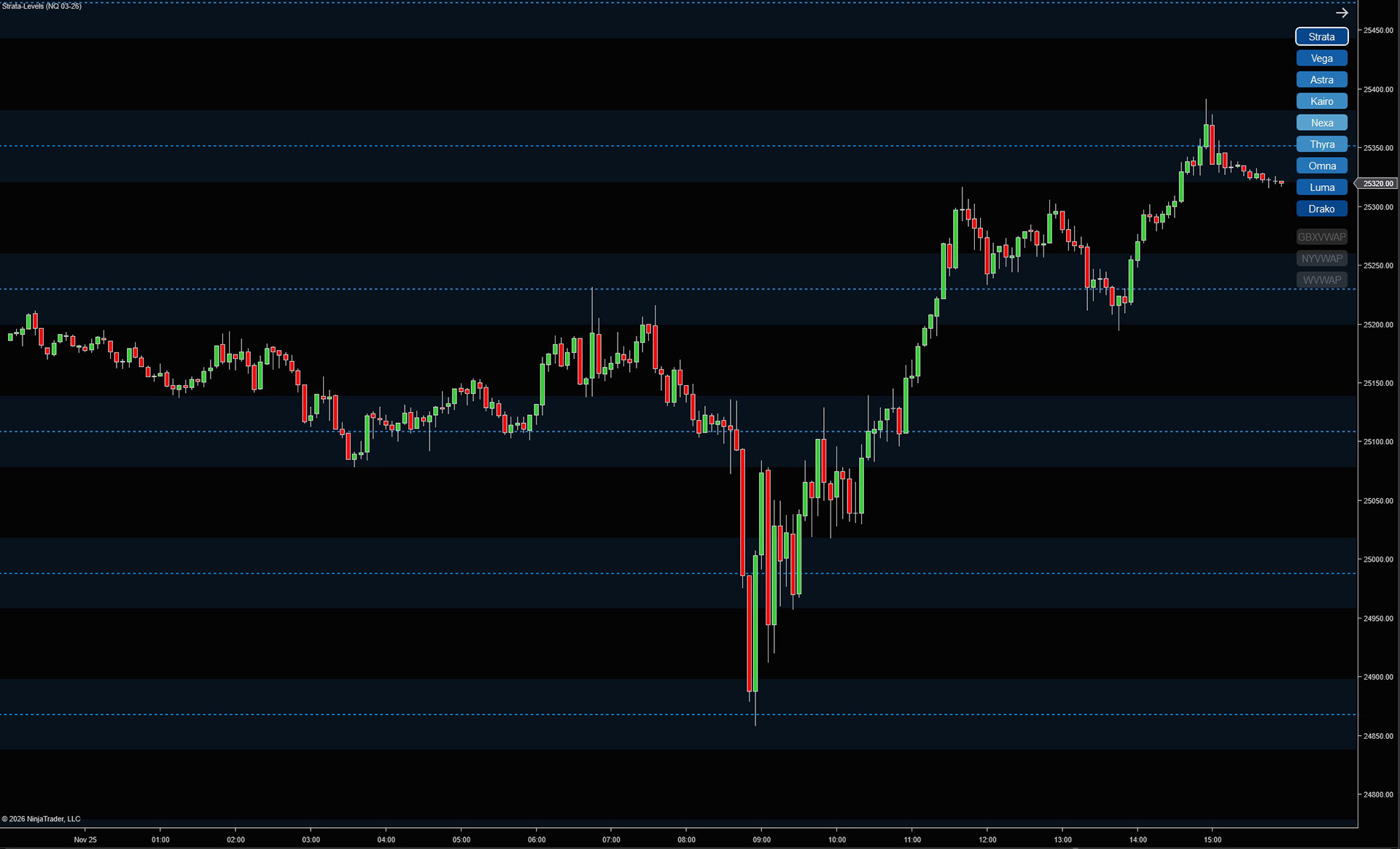

Our Strata Levels framework combines session-based VWAPs with a fixed market structure model to highlight where price is most likely to react, stall, or accelerate. Rather than using VWAP or structure in isolation, Strata Levels shows how they interact — giving traders a clearer picture of context before making decisions.

Establishing a Session Reference.

Most traders are first introduced to VWAP as an intraday reference, plotted from the start of the session and allowed to build cumulatively throughout the day.

On its own, this is already a powerful tool.

Because VWAP accounts for both price and volume, and because it plays a critical role in institutional execution, it naturally becomes a focal point for market activity.

As more volume is transacted, VWAP becomes a real-time representation of the market’s true average price for the session.

Adding Structure to the Volume Weighted Average Price.

While VWAP shows where the average price is, it does not explain how far price has moved away from that average, or whether that distance is meaningful.

Strata Levels introduces a fixed structure grid around VWAP, segmenting price action into distinct zones above and below the session’s center.

This creates an objective framework for answering questions like:

•Is price extended or compressed?

•Is this reaction normal or extreme?

•Is VWAP acting as support, resistance, or simply passing through?

Instead of guessing, price behavior is evaluated relative to structure.

Want to see how this looks on real charts?

Join the free community for daily VWAP + structure breakdowns.

Join the free community for daily VWAP + structure breakdowns.

Extending VWAP Beyond a Single Session.

A common misconception is that VWAP is only useful intraday.

In reality, anchoring VWAP to prior sessions and key events often provides even more context.

Strata Levels includes toggleable VWAPs such as:

•Globex VWAP

•New York session VWAP

•Weekly VWAP

These are calculated using the same principles, but anchored to different timeframes to reflect broader participation.

Anchored VWAPs from previous sessions help reveal:

•Where price previously found balance

•Where longer-term participants may still be active

•Areas of acceptance or rejection that remain relevant

Interpreting VWAP Within Structure.

When VWAP aligns with a Strata Level, that area becomes significant.

These overlaps often mark:

•Areas where price stalls

•Zones where volatility contracts

•Locations where acceleration begins after acceptance or rejection

This is one of the core advantages of Strata Levels:

VWAP is no longer just a line — it’s evaluated within a consistent structural context.

VWAP is no longer just a line — it’s evaluated within a consistent structural context.

Want to see how this looks on real charts?

Join the free community for daily VWAP + structure breakdowns.

Join the free community for daily VWAP + structure breakdowns.

Filtering Market Behavior.

By combining VWAP with fixed structure, market behavior becomes easier to classify.

Instead of reacting to every touch of VWAP, traders can:

•Identify higher-probability reaction zones

•Filter low-quality setups

•Define risk more objectively

From there, trade plans can be built around:

•How price approaches a level

•How it behaves at the level

•Whether structure holds or breaks

Strata Levels does not generate signals.

It provides context, allowing traders to apply their own execution tools with more confidence.

It provides context, allowing traders to apply their own execution tools with more confidence.

Applicability In Trading Markets.

The concepts behind VWAP and market structure are not limited to a single instrument or asset class.

Because institutional participants rely on volume-weighted pricing, these ideas tend to work anywhere meaningful volume exists.

If the instrument is viewable and has data within NinjaTrader, traders can currently apply Strata Levels to:

•Futures (ES, NQ, CL, GC, currency futures, etc.)

•Large-cap and mid-cap equities

•Index ETFs

•Cryptocurrency markets

(If you have a market not listed, and is able to load in NinjaTrader, just ask)

Context First, Execution Second.

While Strata Levels can be used to define entries and exits, its primary role is contextual.

It helps traders:

•Interpret past price behavior

•Assess current conditions

•Make educated assumptions about what is more or less likely to happen next

This naturally splits the process into two phases:

1. Strategic assessment — is this market worth trading right now?

2. Tactical execution — how to manage risk and timing once a setup appears

Not every chart deserves a trade.

Strata Levels helps make that decision clearer before capital is put at risk.

Strata Levels helps make that decision clearer before capital is put at risk.

Responding to Changing Conditions.

The framework itself is not directional.

It supports both:

•Trend continuation scenarios

•Mean reversion scenarios

Long and short applications are evaluated using the same methodology.

As market conditions shift, the tactics may change — position size, hold time, or execution style — but the underlying structure remains consistent.

The goal is not prediction.

It’s alignment with context.

It’s alignment with context.

Revealing Support and Resistance.

We don’t expect anyone to take this at face value.

Below are additional examples showing how price interacts with VWAP and structure across different markets and timeframes.

Want to see how this looks on real charts?

Join the free community for daily VWAP + structure breakdowns.

Join the free community for daily VWAP + structure breakdowns.

Strata Levels is designed to give you context first — not signals.

Start by seeing how VWAP and structure interact on live markets, then decide if it fits your approach.

Start by seeing how VWAP and structure interact on live markets, then decide if it fits your approach.

Contact us or join the free community to see daily chart breakdowns and real examples of Strata Levels in action.

Thank you!